Table of Contents

- Irmaa 2024 Brackets And Premiums Chart Pdf - Risa Verile

- Medicare Premiums and Coinsurance in 2025 - Meld Financial

- Possible 2025 IRMAA Brackets

- 2025 Part D Irmaa Brackets - Adrian Roberts

- Medicare Premiums Based On Income 2025 Irmaa - Hana Clara

- Irmaa 2025 Brackets And Premiums Chart Of Accounts - Jeffrey L. Werner

- Medicare Premiums and Coinsurance in 2025 - Meld Financial

- Irmaa Brackets 2025 And 2026 - Mufi Tabina

- Possible 2025 IRMAA Brackets

- Irmaa 2024 Brackets And Premiums - Eydie Oralee

.png?format=1500w)

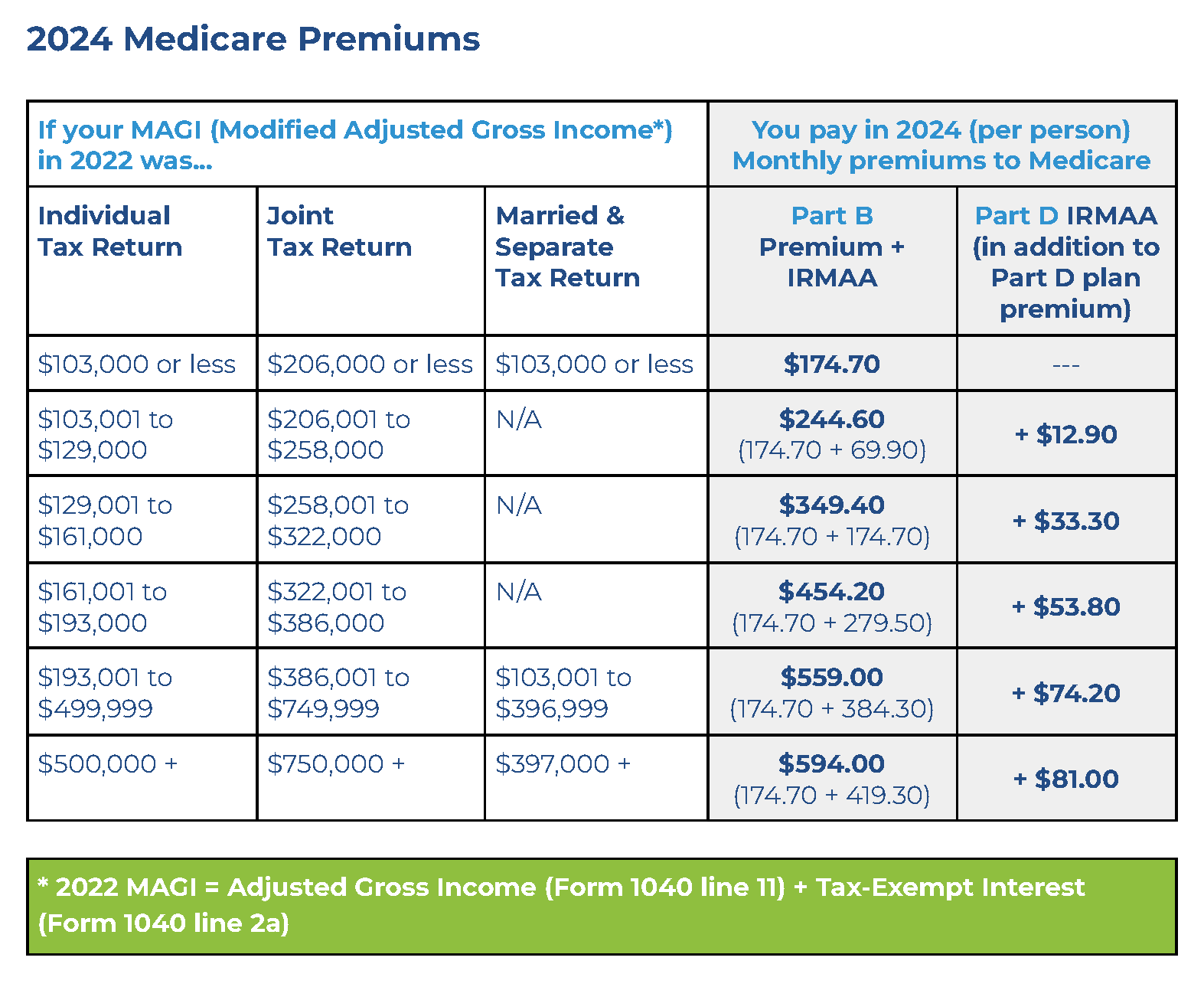

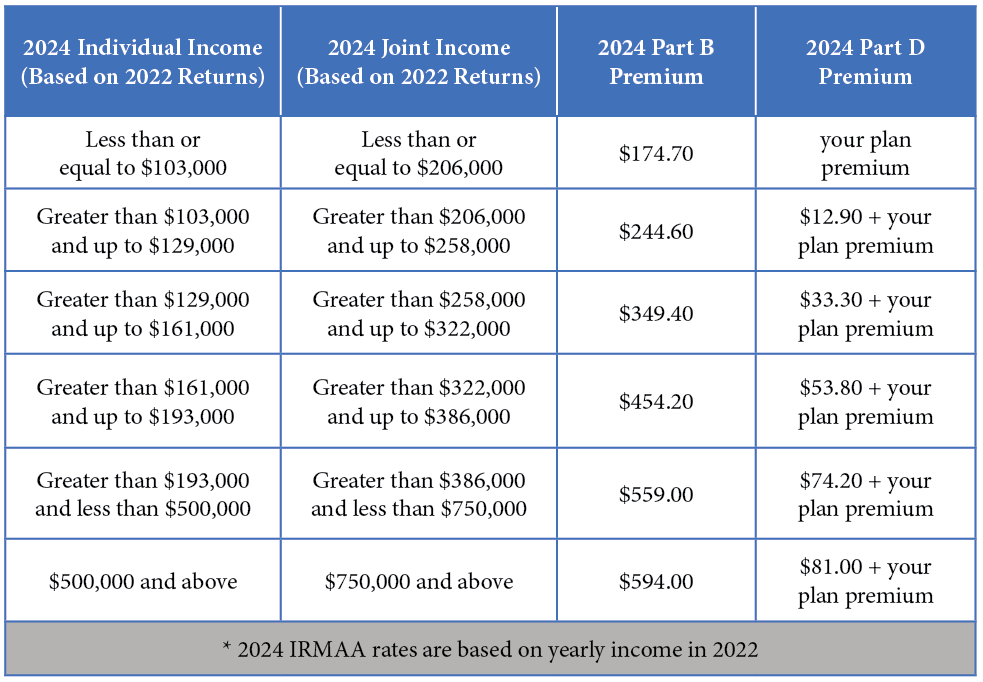

What are IRMAA Brackets?

2025 IRMAA Brackets

- Individuals with a MAGI of $97,000 or less and joint filers with a MAGI of $194,000 or less will pay the standard Part B premium.

- Individuals with a MAGI between $97,001 and $123,000 and joint filers with a MAGI between $194,001 and $246,000 will pay an additional $65.90 per month.

- Individuals with a MAGI between $123,001 and $153,000 and joint filers with a MAGI between $246,001 and $306,000 will pay an additional $136.90 per month.

- Individuals with a MAGI between $153,001 and $183,000 and joint filers with a MAGI between $306,001 and $366,000 will pay an additional $207.90 per month.

- Individuals with a MAGI between $183,001 and $500,000 and joint filers with a MAGI between $366,001 and $750,000 will pay an additional $278.90 per month.

- Individuals with a MAGI above $500,000 and joint filers with a MAGI above $750,000 will pay an additional $349.90 per month.

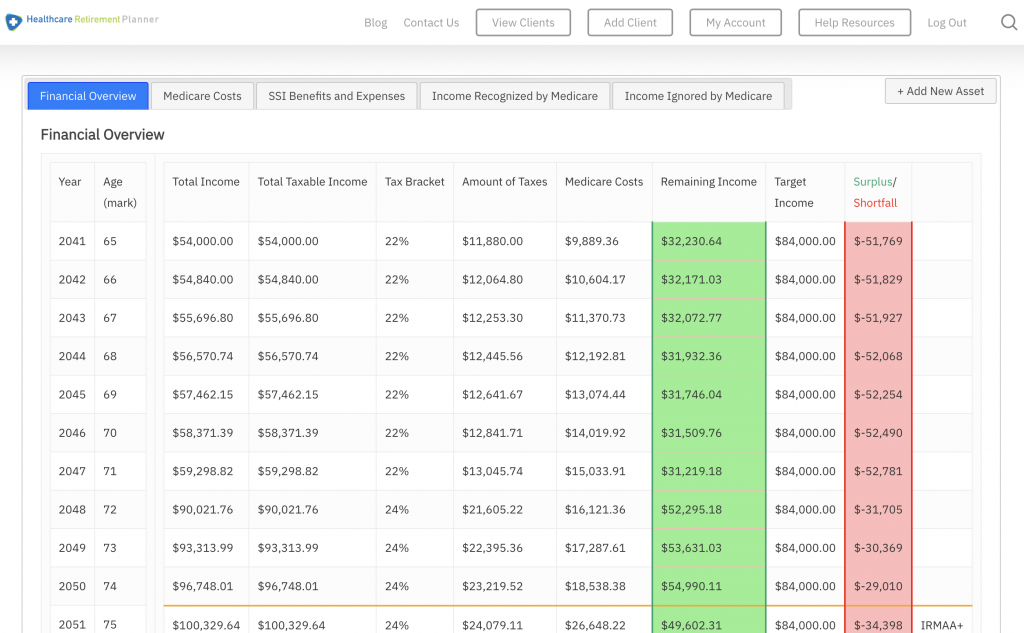

How Do IRMAA Brackets Affect You?

The 2025 IRMAA brackets can significantly impact your Medicare premiums. If you're a high-income beneficiary, you may face higher premiums due to the income-related monthly adjustment. It's essential to review your income and adjust your budget accordingly to avoid any surprises.

Tips for Managing IRMAA Brackets

To manage the impact of IRMAA brackets on your Medicare premiums, consider the following tips: Review your income and adjust your budget to account for potential premium increases. Consider consulting with a financial advisor to optimize your income and minimize the impact of IRMAA brackets. Look into Medicare Advantage plans, which may offer more affordable premiums and additional benefits. The 2025 IRMAA brackets are an essential aspect of Medicare premiums, and it's crucial to understand how they work and how they may affect you. By staying informed and planning ahead, you can manage the impact of IRMAA brackets on your premiums and ensure that you're getting the most out of your Medicare coverage. Remember to review your income and adjust your budget accordingly to avoid any surprises. With the right knowledge and planning, you can navigate the 2025 IRMAA brackets with confidence.For more information on the 2025 IRMAA brackets and how they may affect your Medicare premiums, visit the official Medicare website or consult with a licensed insurance professional.